Social Security Max Taxes 2025

Social Security Max Taxes 2025. In 2025, the social security tax limit rises to $168,600. As of 2025, the maximum taxable earnings for social security taxes have been set at $160,200.

The maximum benefit amount, however, is more than double that. Social security payments are subject to federal income tax in 2025, but only if combined income exceeds certain limits.

The Maximum Benefit Amount, However, Is More Than Double That.

You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

So, If You Earned More Than $160,200 This Last Year, You Didn't Have To.

As of 2025, the maximum taxable earnings for social security taxes have been set at $160,200.

Social Security Max Taxes 2025 Images References :

Source: jackylilian.pages.dev

Source: jackylilian.pages.dev

2025 Maximum Social Security Tax Ailey Anastasie, As of 2025, the maximum taxable earnings for social security taxes have been set at $160,200. So, if you earned more than $160,200 this last year, you didn't have to.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, As of 2025, the maximum taxable earnings for social security taxes have been set at $160,200. Max social security tax 2025 withholding table reyna clemmie, the maximum earnings subject to social security taxes in 2025 is $168,600, which is up from $160,200 in 2023.

Source: salliewtalya.pages.dev

Source: salliewtalya.pages.dev

What'S The Max Social Security Tax For 2025 Carin Cosetta, This is a significant update from the $147,000 cap in 2022. Up to 50% of your social security benefits are taxable if:

Source: shanivivianne.pages.dev

Source: shanivivianne.pages.dev

Social Security Max 2025 Deduction Andra Blanche, Workers earning less than this limit pay a 6.2% tax on their earnings. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Source: reynaqaurelea.pages.dev

Source: reynaqaurelea.pages.dev

Maximum Social Security Tax Withholding 2025 Olympics Elane Xylina, As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the. The wage base or earnings limit for the 6.2% social security tax rises every year.

Source: allysonwranna.pages.dev

Source: allysonwranna.pages.dev

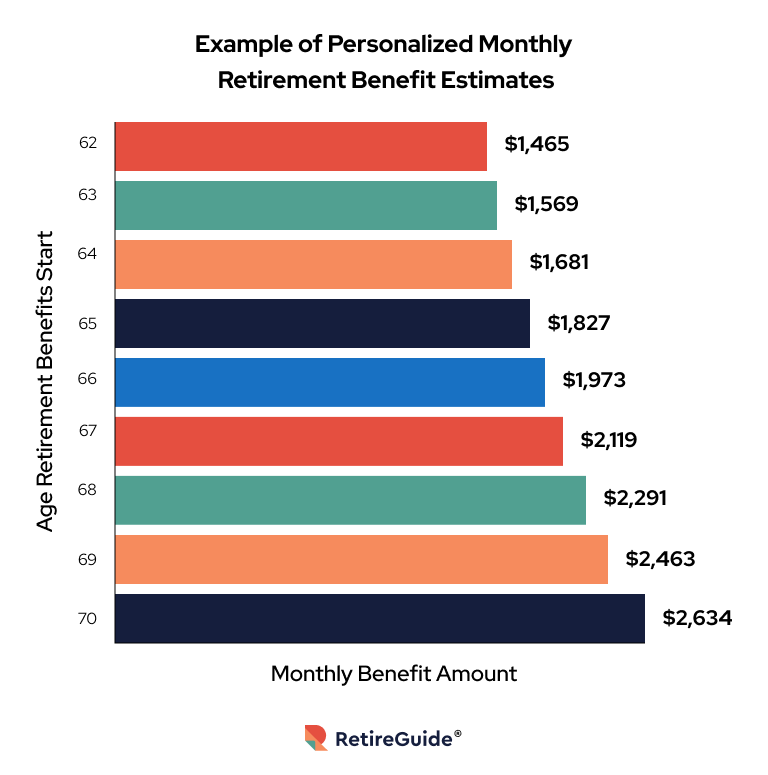

What Is The Maximum Social Security Tax 2025 Emalee Alexandra, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62. Workers earning less than this limit pay a 6.2% tax on their earnings.

Source: annnorawgrace.pages.dev

Source: annnorawgrace.pages.dev

Social Security Maximum Taxable Earnings 2025 Diann Florina, As of 2025, the maximum taxable earnings for social security taxes have been set at $160,200. The limit for 2023 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, Millionaires are set to hit that threshold in march and won’t pay into the program for the rest of the. For 2025, the social security tax limit is $168,600.

Source: berrieqkarlee.pages.dev

Source: berrieqkarlee.pages.dev

Max Ss Benefit 2025 Kyle Shandy, Max social security tax 2025 withholding table reyna clemmie, the maximum earnings subject to social security taxes in 2025 is $168,600, which is up from $160,200 in 2023. The 2025 limit is $168,600, up from $160,200 in 2023.

Source: sabinawree.pages.dev

Source: sabinawree.pages.dev

Social Security Max Allowed 2025 Calendar Dredi Lynnell, This is a significant update from the $147,000 cap in 2022. The wage base or earnings limit for the 6.2% social security tax rises every year.

As Your Total Income Goes Up, You’ll Pay Federal Income Tax On A Portion Of The Benefits While The.

It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

In 2025, Up To $168,600 In Earnings Are Subject To Social Security Payroll Taxes.

A set of conservative policy proposals known as project 2025 has become a lightning rod for opponents of republican presidential candidate donald trump as they.

Posted in 2025